The banking industry has switched to mobile applications for business operations with a need to deliver a great user experience. Mobile banking apps have streamlined services for users and financial institutions. The competitive environment and high demands of users have compelled banking organizations to take action and collaborate with a reliable mobile banking app development company that can help them build robust and highly scalable applications. This blog will serve as a comprehensive mobile banking app development guide.

Electronic banking and online stock trading was the first step towards the significant change we see today. Evolution is the necessity of growth. The Banking Industry has wholly evolved with mobile apps. The primary reason for the mobile banking app’s popularity is personalization and time. A survey conducted by Accenture predicts that around 80% of the users are ready to share data in return for personalized services.

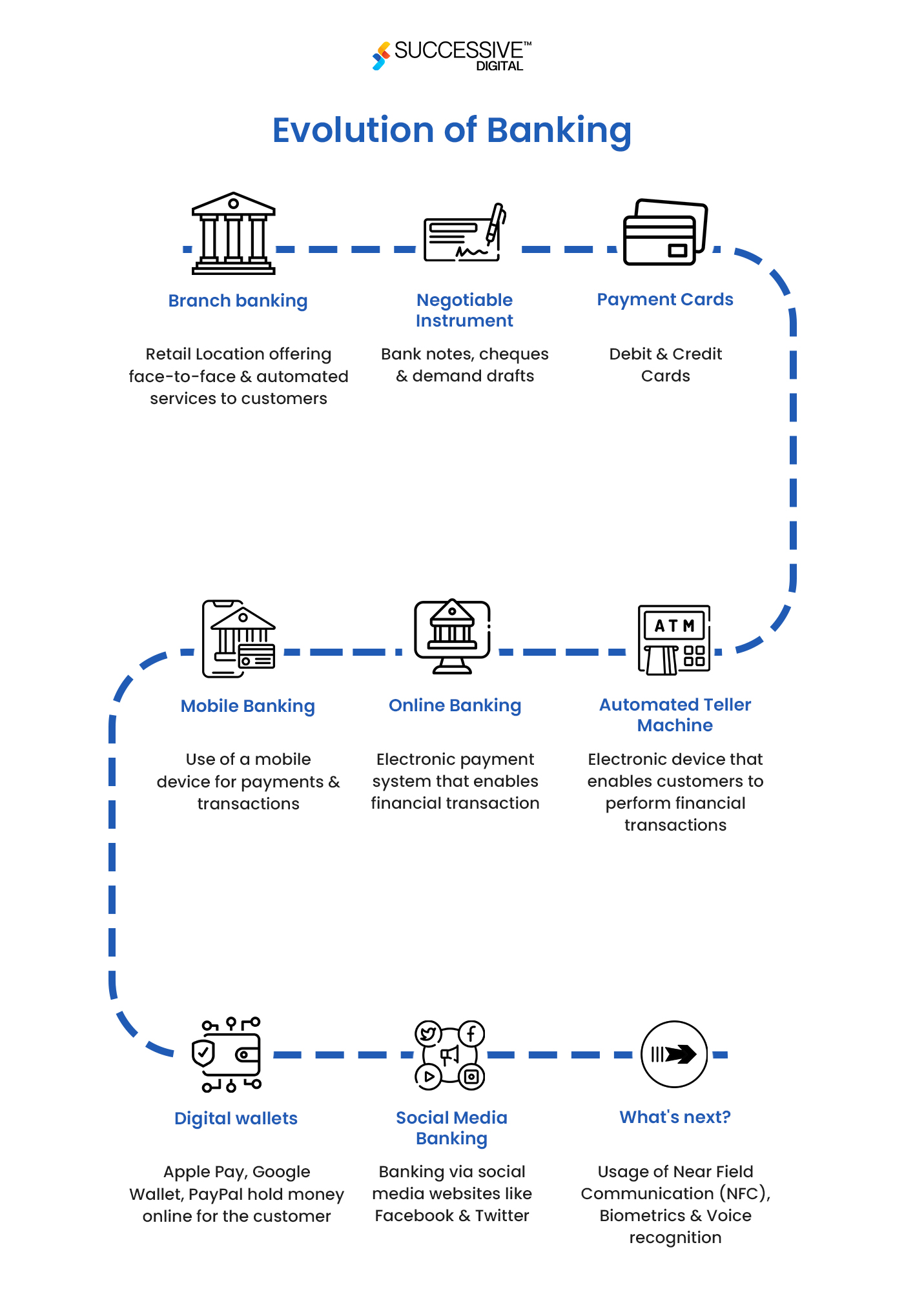

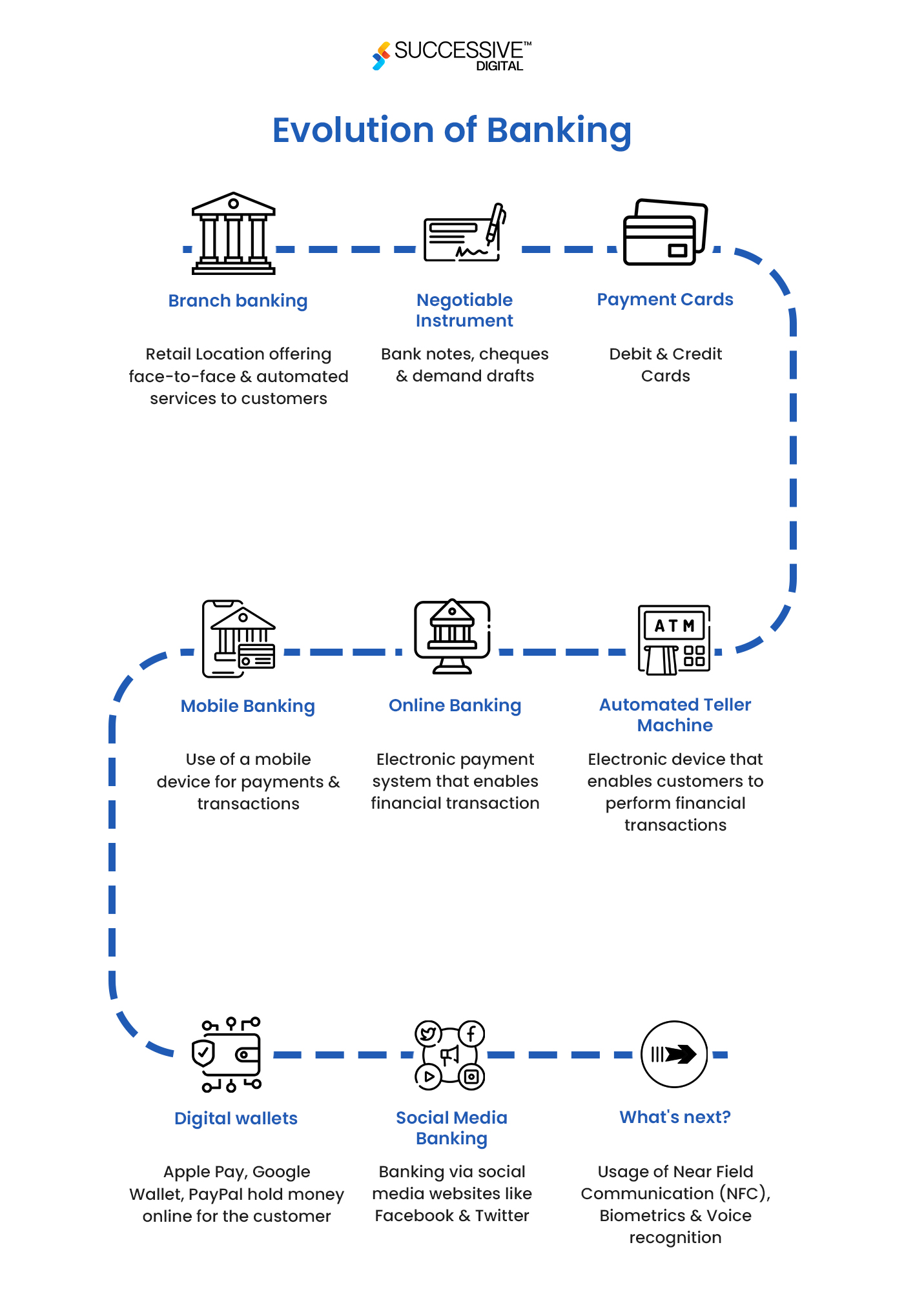

Today, users leverage mobile banking apps for digital transactions, virtual card payments, loan approval, and setting up their long-term and short-term financial goals. The image below shows the evolution of banking operations:

There are multiple benefits of mobile banking apps. Let’s understand how users can leverage it and what benefits a bank can have with mobile banking applications.

Some banking apps combine various financial services onto a single platform, including banking, investing, and insurance. These applications strive to give users a thorough financial management experience. Apps like Ally and Discover Mobile are perfect examples of multifunctional apps.

In 2011, the Royal Bank of Scotland made history by launching the world’s first-ever feature-rich mobile banking app. Today, more than 90% of the population utilizes digital or mobile banking. With everything being online, the security risks increase, too. Data security is one of the most crucial factors in developing a mobile banking app. Let’s have a look at the challenges that can arise during mobile banking app development:

The number of data breaches has increased over the last few years. It is essential to encrypt data with exemplary security standards to avoid any hassle in the future. As mobile banking apps solely function on user data, developers must utilize the latest security tools and techniques like two-factor or multi-factor authentication. They must ensure regulatory compliance to provide a safe environment for users.

Your application is going to serve users globally. However, achieving regulatory compliance takes a lot of work. Below are some necessary compliances to consider while developing your mobile banking app:

Research the pain points and the demands of users. This will help developers to create a ready-to-market app. Even if you have a solid online presence, your app must satisfy consumers. If your app doesn’t perform well, it can also hamper your reputation. A robust, feature-rich application helps you stand ahead of your competitors.

Mobile banking applications are very popular as they ease customers’ lives. Here is the step-by-step process of building your mobile banking application.

STEP 1: RESEARCH

This is one of the most crucial steps to be taken if you are considering getting a mobile application developed. It’s essential to have a thorough competitive analysis of the market and your competitors. Proper research helps you build the right strategy. You need to list all the essential points, like who the users are, their pain points, and how to address each. The output should be a detailed mobile banking app development plan with all estimates. A thorough analysis gives you all the information from user persona to value proposition.

STEP 2: BUILD PROTOTYPE

Mobile banking apps are complex projects, so it is essential to understand the specifications and build prototypes. After the prototype approval, further actions can be taken. Make sure you know the requirements and expectations. Building a prototype is a comprehensive process that helps understand the scope of future work and design a product that meets users’ needs.

STEP 3: SETTING UP A ROBUST SECURITY BASE

Data Security is the primary element that needs to be taken care of while developing a robust mobile banking app. Some organizations will only hire you to create applications that offer strong security. Security is non-negotiable in the banking domain. One must follow robust authorization protocols, security encryptions, two-factor authentication, and other added security while developing a mobile banking application.

STEP 4: WORK ON USER EXPERIENCE

In this step, the design team or the designer should roll up their sleeves and start working. If you are building an application to facilitate your customers, delivering a great user experience is vital. Navigation should be smooth, and the app should be user friendly. If you are dealing with any operation that involves money handling, it must not have any chances of error that can trigger users. When users deal with a big chunk of money, they are nervous. That’s why developing a simple, intuitive, user-friendly interface is essential.

STEP 5: FINAL DEVELOPMENT

And here comes the final development phase. All the research, design, prototype, and testing come to an end point where the final development takes place. Now, you know the exact requirements and have the right strategy to develop and position your mobile banking application.

STEP 6: ADD INTEGRATIONS

Third-party integrations can make your application more customer-centric and feasible. It gives a user-friendly app flow while improving customer retention. Third-party integration services include payment aggregators, payment gateways, and much more. Choose them carefully, as they can either make your application boom in the market or be ultimately doomed.

STEP 7: LAUNCH

Here comes the final step- THE LAUNCH! Launch it to your target audience after all your efforts to develop the application. But it’s not the end. Just after your product reaches the users, a new journey begins. With this comes new requirements, demands for new features, and much more. You need to monitor your app’s performance and continually work towards improving it every day.

A mobile banking app should be designed explicitly for users. Adding the right features to the app will enhance its adoption and acceptance among users. Let’s understand what features your mobile app must have.

These features should be present in a mobile banking app.

USER IDENTITY

BALANCE AND TRANSACTIONS

DEPOSITS AND WITHDRAWAL

LOAN MANAGEMENT

BIO AUTHENTICATION

EXPENSE TRACKING

CUSTOMER SUPPORT

DIGITAL WALLETS

ADVANCED SECURITY

Below are the advanced features that can make a mobile banking app more engaging and feasible for consumers.

CARDLESS ATM ACCESS

INTEGRATION WITH MODERN TECHNOLOGIES LIKE AI/ML

NOTIFICATIONS

INVESTING

GEOLOCATION

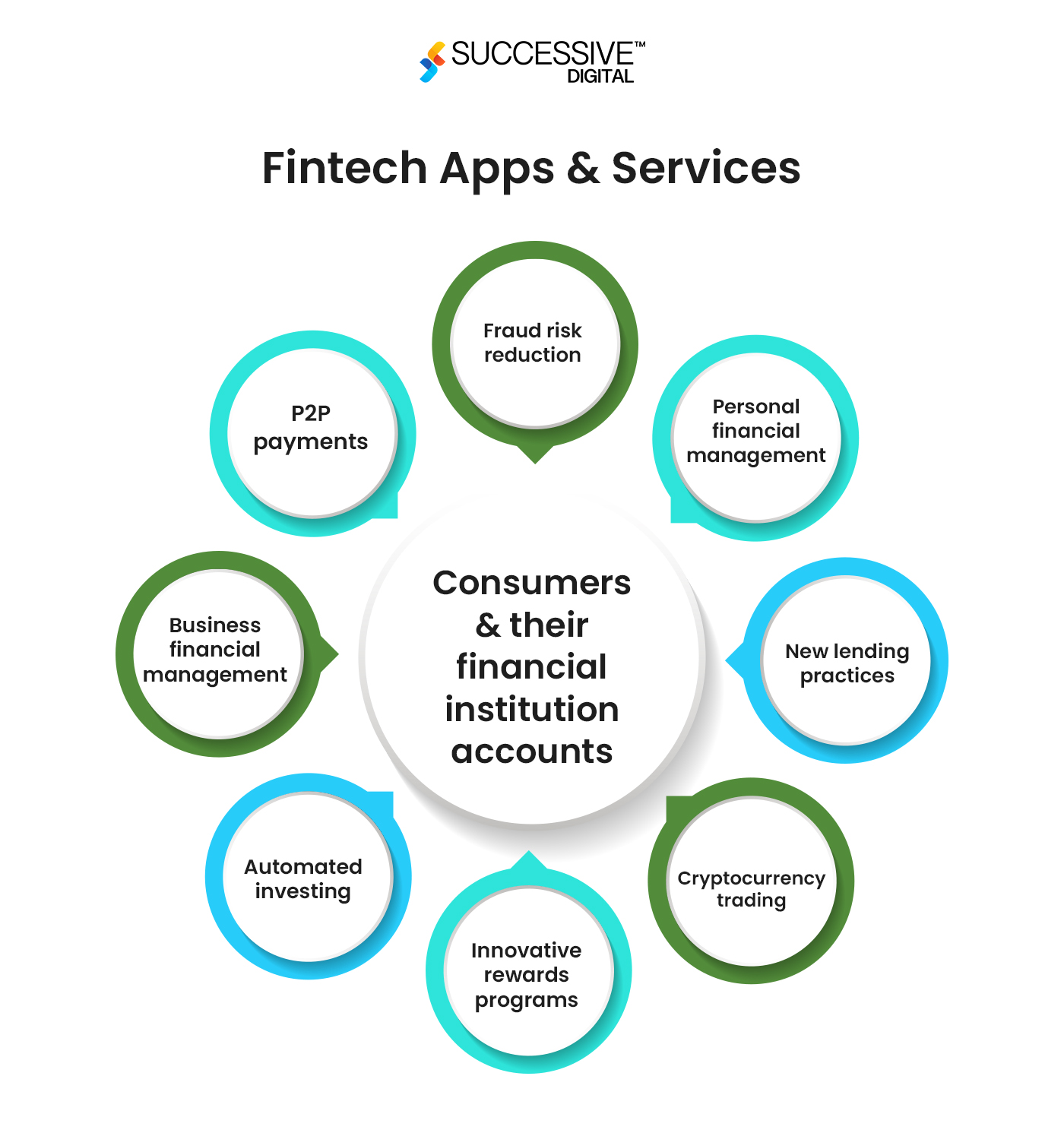

Mobile apps have created a vast financial ecosystem by being integrated with bank accounts. Bank accounts are the center of this universe, and the other additional services are a part of it. Because of the emergence of advanced financial products, this interconnected ecosystem is the breeding ground for transformation.

Even the most prominent financial institutions have been compelled by these developments to provide better digital products and improve customer experiences while reducing costs. Customer expectations have evolved as people get comfortable accessing numerous mobile services.

As a result, there is now a demand for businesses to offer customers effective and uniquely personalized products and services. New technologies have normalized the ability for users to access a range of services within a single app, transforming platforms into multi-service ecosystems.

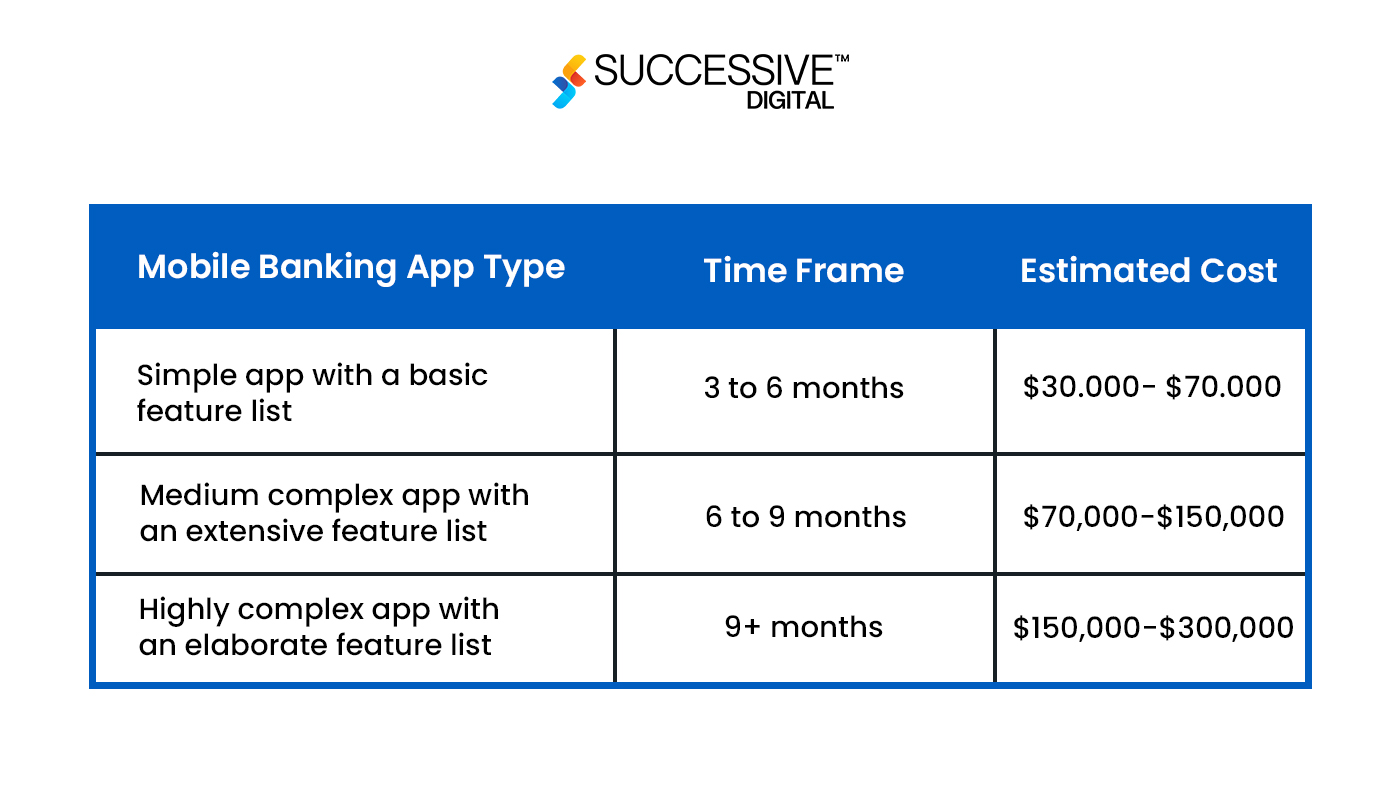

Mobile app development costs depend on various factors, like the technologies you use and the time you invest. But, it is total development hours X hourly rates of developers. Below is the visual representation of the cost:

Multiple factors affect the overall mobile banking app development cost. Let’s have a detailed look at each aspect:

A wireframe, created with the help of programs like Figma or PhotoShop, is the general architectural design or blueprint of the layout of the banking application. The final wireframe that provides a clear product vision is created after multiple testing processes. A wireframe design typically costs between $8,000 and $10,000.

A mobile banking application typically contains information about accounts, money transfers, customer support, an active chatbot, and many other features that can enhance the app’s performance—creating a simple design that can add all the information in one location. A minimalistic design is the right way to move forward. It makes navigation easier, improves customer retention, and keeps them engaged.

The mobile banking app’s base platform affects how much it costs. Even while selecting an iOS or Android platform typically has little impact on the overall budget for the app, it is generally preferred to begin with the latter due to its large user base. You can easily choose to have your banking app developed first for a single platform before switching to cross-platform app development once the app starts to acquire some popularity in the market.

Cost estimation highly depends on team size. What you wish to accomplish largely relies on your financial situation. If you already have an internal app development team, funding should be within your financial capabilities. If not, you need to outsource your mobile banking app’s development team or individual. Even though they can initially charge you a little bit more, a trustworthy banking app development service provider will promise a better ROI due to their quality of services.

Technology integration is another vital factor directly proportional to the cost of developing a banking app. Integrating advanced technologies like AI/ML and blockchain is advised, as they can benefit you in the long run. Incorporating these technologies will make your app premium but will increase costs simultaneously.

The more features it will have, the more you will pay. Adding the correct set of features is one of the most essential elements in the development process of mobile banking apps. The development cost will significantly increase as you have more complex or advanced features.

This is the last but ongoing step, even after the launch of your application. This factor is the most critical variable that determines your overall development cost. After all, it’s essential to maintain the quality of your mobile banking app to enable a great user experience. It is necessary to understand that after the launch, the app has user data and actions involved, so application maintenance becomes essential. The app will need routine hygiene checks, ongoing bug detection and removal, and frequent updates.

At every enhancement step of the application, the cost will increase respectively.

Citi Mobile: The Citi Mobile app from Citibank was developed to facilitate users with simple account management. You can access several financial services with Citi Mobile, including checking account balances, transaction history, paying bills, and transferring money. It has a customer rating of 4.1 and is very popular among users.

Bank of America Mobile Banking: Due to its extensive selection of services and excellent user interface, Bank of America’s Mobile Banking app has a user rating of 4.7. The Bank of America Mobile Banking app will help you with any needs, like checking your account balances, paying payments, and finding an ATM.

Chase: One of the biggest banks in the US, JPMorgan Chase, developed the mobile banking app Chase Mobile. It has a customer rating of 4.7. Various banking and money management tools are available in the app, making it simple for users to access accounts, keep tabs on spending, control budgets, and initiate transactions.

The Ally: A feature-rich and easy-to-use mobile banking app that combines standard banking operations with investment choices. Many mobile banking apps emphasize banking services, while Ally covers both aspects of personal finance and offers customers a complete set of tools for managing their money. It is trendy for making investments and has a rating of 4.2.

Discover Mobile: Discover Bank customers can use the Discover Mobile app to manage their deposit accounts and credit cards from a single platform. The app is user-friendly and robust, with many functions that customers can leverage to manage their finances most efficiently. It has a user rating of 4.4.

Successive Digital has been an ambitious leader in transforming business operations for many industries with advanced software solutions for over a decade. With our reliable and affordable app development services, you can create high-quality applications tackling traditional challenges and sophisticated business methods.

Successive is a brand offering scalable solutions for 10+ years; it has a global presence and is continuously helping businesses to bring change and transform globally in the digital era. We use efficient and agile development processes to create solutions that align with your requirements. So, if you want to create a scalable and unique application, contact us for further assistance.

One of our industry-leading clients delivering exceptional commerce experience understood the importance of apps in the market. They modernized their application and infrastructure on AWS. They utilized advanced technologies like microservices, containerization, serverless architecture, and DevSecOps to reduce time, cost, and complexity. Additionally, they improved their UI/UX and developed a robust user interface. They also developed an intuitive portal for the citizens to view and pay bills.

It helped them manage their application more efficiently and scaled performance, resulting in customer satisfaction. By following a customer-centric approach, our client adopted an electronic payment solution, developed a utility bill payment solution, enrolled in autopay, and enabled easier reconciliation of payment deposits. They also allow real-time payment and service-related notifications to improve customer retention and make a standard application.

Developing a banking app is an excellent way to meet your users’ needs and give them a positive banking experience. The popularity of digital alternatives has completely disrupted the traditional finance system. This guide will help you execute your mobile banking app development ideas into reality. If you want to develop a mobile banking app, now is the time to leverage the latest trends and technologies and build an advanced solution for your customers. However, regarding financial operations, the main focus will be data security. This is why working with a reliable and established app development company with a proven track record of developing robust applications and helping businesses grow is essential.

To make your mobile banking app compliant with financial constraints, work with legal experts and know all about your region’s financial rules and regulations and the target region. Adhere to data protection standards and add strong security measures.

What advanced features can I add to my mobile banking app?Advanced features include the integration of mobile banking apps with modern technologies. You can add features like cardless ATM access, geolocation, customized alerts, etc.

What technology stack is used for developing mobile banking apps?Cross-platform solutions allow for greater flexibility and are cost-effective. React Native, Flutter, and Xamarin are all part of the tech stack for this. Cordova and Ionic can be utilized for hybrid application development.

Can we utilize Node.Js for mobile banking app development?Yes, Node. Js makes it simple for developers to transfer data from the server to the client. It is a well-known platform for creating scalable and quick mobile and online applications.