More than 65 million people—nearly 20% of the U.S. population—receive their health insurance coverage through the federal Medicare program. In 2021, Medicare spending comprised one-fifth (21%) of national health care spending and 13% of the federal budget. The largest share of total Medicare spending (48% in 2021) is dedicated to Part B services, including physician services, outpatient services, and physician-administered drugs, and accounts for 26% of national payments for physician and clinical services.

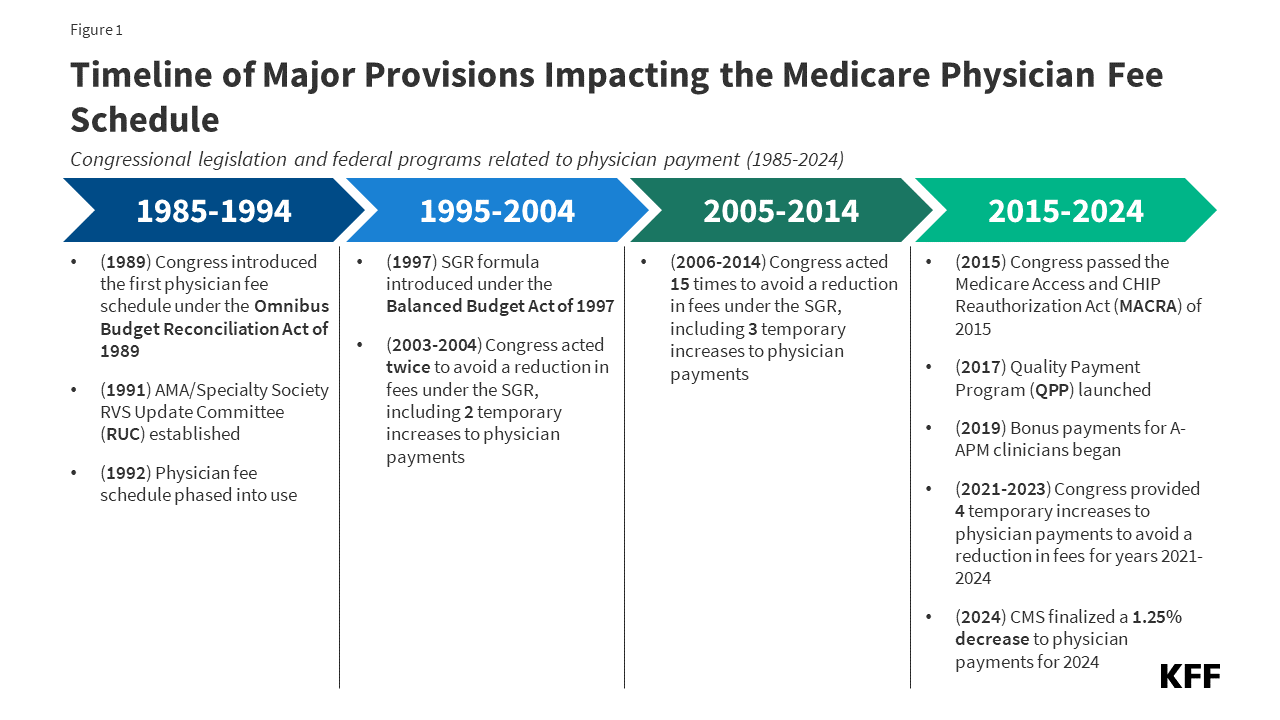

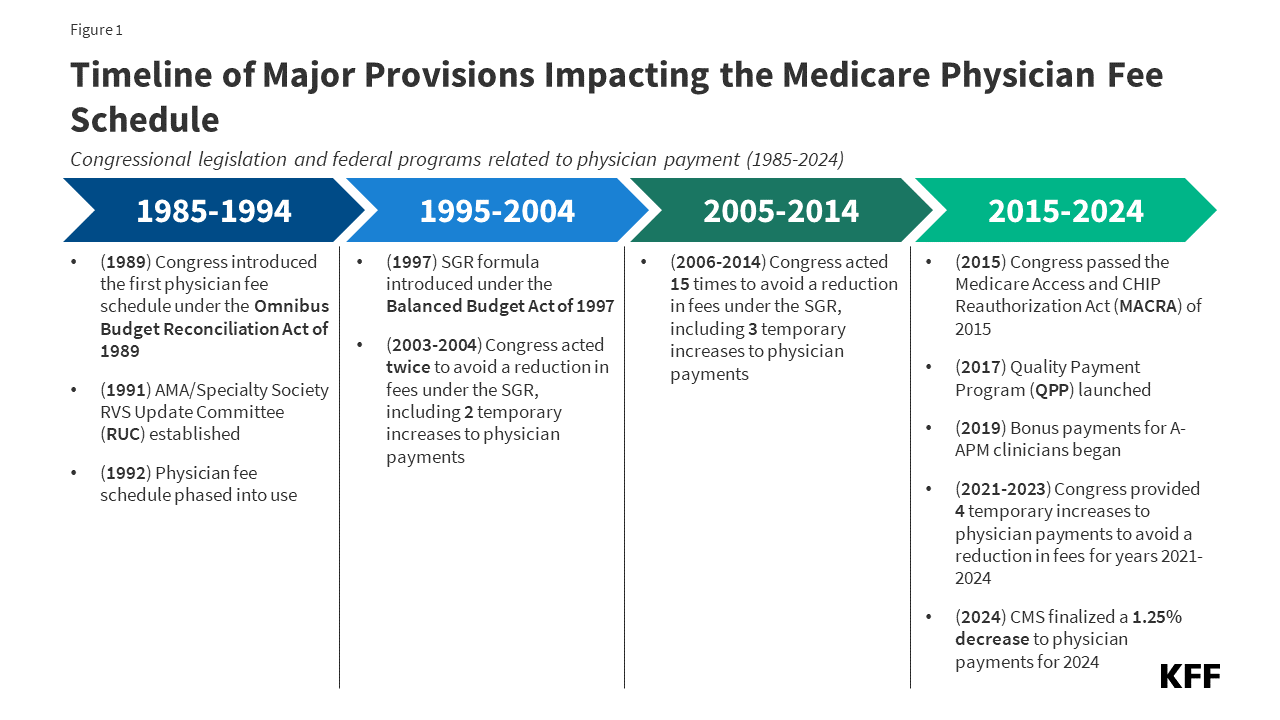

Each year, the Centers for Medicare and Medicaid Services (CMS) updates Medicare payments to physicians and other clinicians through rulemaking, based on parameters established under law. In November 2023, CMS finalized a 3.4% decrease in the physician fee schedule conversion factor, a key aspect of payment rates under the Medicare program, resulting in a 1.25% decrease in overall payments that is expected to vary by specialty. These changes, along with several others, went into effect on January 1, 2024 (Figure 1). Congress is expected to vote on legislation that would mitigate these payment reductions temporarily, from March 9, 2024 through the remainder of the year.

Figure 1: Timeline of Major Provisions Impacting the Medicare Physician Fee Schedule

Physician and other professional groups, including the American Medical Association, the Medical Group Management Association, and the American Hospital Association, have opposed the payment cuts and expressed concerns that loss of revenue could push physicians to opt out of the Medicare program, leading to access problems for Medicare beneficiaries. Physicians are not required to take Medicare patients, but most do; just 1% opted out of the program in 2023.

The new legislation that adjusts physician payments through the remainder of the year is one of several recent proposals from policymakers aimed at canceling out or mitigating these payment reductions. Since 2020, Congress has enacted four temporary, one-year increases to physician payment rates to avoid reductions in fees. Others, including MedPAC, have proposed broader changes to address concerns with the current payment system. A bipartisan group of senators recently announced the formation of a Medicare payment reform working group, with the goal of investigating long-term reforms to the physician fee schedule, and additional legislation is expected later in the year.

This issue brief answers key questions about how physicians are paid under the Medicare program, and reviews policy options under discussion for payment reform. The brief is focused primarily on the physician payment system used in traditional Medicare, as Medicare Advantage plans have flexibility to pay providers differently; currently there is no information on how much Medicare Advantage plans pay providers. (See Appendix for a glossary of relevant programs, legislation, and terms.)

Medicare reimburses physicians and other clinicians based on the physician fee schedule, which assigns payment rates for more than 10,000 health care services, such as office visits, diagnostic procedures, or surgical procedures. For services provided to traditional Medicare beneficiaries, Medicare typically pays the provider 80% of the fee schedule amount, with the beneficiary responsible for a maximum of 20% in coinsurance. Physicians who participate in Medicare agree to accept this arrangement as payment in full (known as accepting “assignment”) for all Medicare covered services. Others, known as non-participating physicians, may accept “assignment” on a claim-by-claim basis and may choose to bill for larger amounts by charging additional coinsurance, up to a limit. Physicians who opt out of the program altogether enter into private contracts with their Medicare patients, are not limited to charging fee schedule amounts, and do not receive any reimbursement from Medicare.

Fee schedule rates for a given service are based on a weighted sum of three components: clinician work, practice expenses, and professional liability insurance (also known as medical malpractice insurance), measured in terms of relative value units (RVUs). Together these three components represent the overall cost and effort associated with a given service, with more costly or time-intensive services receiving a higher weighted sum. Each component is adjusted to account for geographic differences in input costs, and the result is multiplied by the fee schedule conversion factor (an annually adjusted scaling factor that converts numerical RVUs into payment amounts in dollars).

Payment rates specified under the physician fee schedule establish a baseline amount that Medicare will pay for a given service, but payments may be adjusted based on other factors, such as the site of service, the type of clinician providing the service, and whether the service was provided in a designated health professional shortage area. Physicians can also receive quality-based payment adjustments under the Quality Payment Program (QPP) (see question 6).

Annual updates to the physician fee schedule include statutorily-required updates to the conversion factor under the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA) (see question 5), as well as other adjustments to reflect the addition of new services, changes in input costs for existing services, and other factors. A multispecialty committee of physicians and other professionals, known as the AMA/Specialty Society RVS Update Committee (RUC), issues annual recommendations to advise CMS on the weighting of new or revised service codes.

Under current law, the projected cost of all changes to the physician fee schedule must be budget neutral, that is, the changes may not raise total Medicare spending by more than $20 million in a given year. This requirement was established by the Omnibus Budget Reconciliation Act of 1989 to address concerns that constraints on physician fees for specific services would lead to increases in service volume, potentially driving growth in Medicare spending for physician services over time. The law requires CMS to adjust fee schedule spending when projected costs exceed the threshold, typically by decreasing the conversion factor relative to the statutory update called for by MACRA.

CMS recently finalized payment changes for 2024, including increases in payment for a range of services related to primary care, behavioral health, and direct patient care, among others (see question 4). Due to the statutory requirement under the Omnibus Budget Reconciliation Act of 1989 that CMS preserve budget neutrality when adjusting physician payment rates, these service-specific increases necessitated a decrease to the fee schedule conversion factor to offset additional costs. Budget neutrality adjustments are made separately from statutory adjustments under MACRA and any temporary payments provided by Congress, both of which may also impact the conversion factor in a given year.

The 3.4% decrease to the conversion factor finalized for 2024 reflects the following adjustments to these three factors: (1) a -2.18% budget neutrality adjustment, (2) a 0% statutory increase under MACRA for 2024, and (3) -1.25% reduction in temporary payments provided by Congress for 2024 under the Consolidated Appropriations Act of 2023.

The combined impact of these changes is a -1.25% decrease in overall payments under the physician fee schedule relative to 2023, according to CMS. Payment changes are expected to vary by specialty, however. For example, clinicians most directly impacted by service-specific changes, such as those in primary care and behavioral health, are projected to see a net increase in payments, while clinicians in radiology, physical and occupational therapy, and some surgical specialties are projected to see the largest net decrease.

Congress is expected to vote on pending legislation which would mitigate the 3.4% decrease to the fee schedule conversion factor, a change which is expected to result in a modest increase to physician payment rates across all specialties, relative to current law.

Many of the provisions in the physician fee schedule final rule for 2024 are part of a wider effort by CMS and the Department of Health and Human Services (HHS) to improve health equity and increase support for primary care services, addressing long-standing concerns about the gap in compensation between primary and specialty care physicians (see question 7). CMS has also implemented two provisions of the Consolidated Appropriations Act of 2023, which expand Medicare coverage for a range of behavioral health services. The final payment rule for 2024 includes the following key changes:

The new rules also include updates to the Medicare Shared Savings Program (MSSP), as well as other changes related to payment for opioid treatment programs, preventive vaccine administration, and a variety of other health services.

Medicare has revised its system of payment for physician services numerous times over the years (Figure 1). The current payment system was established under the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA), which included a schedule for annual, statutorily-defined updates to the conversion factor, a key determinant of payment rates under the physician fee schedule. These updates are set by legislation and do not vary based on underlying economic conditions. However, further adjustments to preserve budget neutrality and supplemental payments provided by Congress may result in conversion factor updates that are higher or lower than the statutory update in a given year.

The physician payment framework established by MACRA was intended to stabilize fluctuations in payment caused by the prior payment system under the Medicare Sustainable Growth Rate (SGR) formula, which set annual targets for Medicare physician spending based on growth in the gross domestic product (GDP). Under the SGR, if spending exceeded its target in a given year, payment rates would be cut the following year, while spending that was below the target led to increased rates. As with the current system, rates were subject to further adjustment for budget neutrality if the projected cost of all fee schedule spending increased by more than $20 million for the year.

The SGR was established by the Balanced Budget Act of 1997 to slow the growth in Medicare spending for physician services, but the formula garnered criticism, as growth in service volume and rising costs led to several years of spending that exceeded the growth target, necessitating payment cuts from 2002 onward. Between 2002 and 2015, Congress enacted 17 short-term interventions (so-called “doc-fixes”) to delay the cuts and provide temporary increases to physician payments, but did so without repealing the SGR, which resulted in accumulated deficits over time.

MACRA permanently eliminated the SGR formula, preventing a 21.2% cut in physician fees slated for 2015 and replacing it with 0% statutory increases to the conversion factor through 2025 (later raised to 0.5% from 2016-2019), followed by modest annual increases from 2026 onward. While overall payments were not scheduled to increase for the first decade of MACRA’s operation, the legislation also included new pathways to allow for payment increases through bonus payments and quality-based payment adjustments under the Quality Payment Program (QPP) (see question 6).

Although MACRA has stabilized payments under the physician fee schedule to some degree, rates have continued to fluctuate over the last decade. Since 2020, Congress has provided four temporary, one-year increases to fee schedule rates to boost payment during the COVID-19 pandemic and offset prior budget-neutrality cuts, raising concerns that the cycle of “doc-fixes” under the SGR formula has not been wholly fixed (see question 7).

The Quality Payment Program (QPP) was established by MACRA in 2015 to create financial incentives for health care providers to control costs and improve care quality. Under the QPP, physicians and other clinicians who participate in qualified advanced alternative payment models (A-APMs), such as select accountable care organizations (ACOs) and others, are eligible for bonus payments if they meet certain participation thresholds. A-APMs are a type of value-based care model in which the provider bears some financial risk for the costs of care, typically by sharing in a portion of financial savings and losses relative to a benchmark. Qualifying A-APM clinicians receive an annual 5% bonus through 2024, which will be lowered to 3.5% in 2025, and replaced with an annual 0.75% increase to the conversion factor beginning in 2026 (relative to a 0.25% increase for all other clinicians). Roughly 240,000 clinicians received this bonus in 2022, based on participation during the 2020 payment year.

Clinicians who do not participate in A-APMs, or do not meet the participation criteria for A-APM bonus payments, are subject to additional reporting requirements under the Merit-based Incentive Payment System (MIPS), which adjusts payments up or down depending on a clinician’s performance on certain quality metrics. Clinicians are required to participate in MIPS if they are eligible, but many are exempt, such as those in certain specialties (e.g., podiatrists), those in their first year of Medicare participation, and those who serve a low volume of Medicare patients. Roughly half of all Medicare Part B providers (49%) were eligible for MIPS in 2019.

Payment adjustments under MIPS are capped each year (between +9% and -9% in 2022), and savings generated from clinicians who incur negative adjustments are used to fund positive adjustments for those who qualify. Because a relatively small share of clinicians have incurred negative adjustments each year since MIPS was implemented, positive adjustments have generally been much lower than the annual cap. In 2022, roughly 850,000 clinicians received positive adjustments up to 1.87%, while just 19,000 clinicians received negative adjustments down to -9%.

Criticism of the recent payment cuts under the physician fee schedule has focused on three primary concerns about the way in which Medicare pays physicians and other clinicians. These include: (1) the overall adequacy of Medicare payments to cover medical practice costs and incentivize participation in the Medicare program, (2) the gap in compensation between primary and specialty care clinicians, and (3) the success of the QPP at achieving its goal of incentivizing quality improvements and cost-efficient spending.

Payment Adequacy: Physician groups and others have expressed concern that certain aspects of the current payment system, such as the requirement for budget neutrality under the physician fee schedule and the limited flexibility of conversion factor updates under MACRA, have resulted in payment rates that are too low to keep up with inflation in medical practice costs. Practice expenses are one component of the relative-value calculation used to determine payment rates for fee schedule services, but the need to preserve budget neutrality makes it difficult for CMS to increase payment for some services without also decreasing payment in other areas, such as by lowering the fee schedule conversion factor.

Physician groups and others have pointed out that statutory increases to the conversion factor under MACRA are not scheduled to begin until 2026, and do not vary based on underlying economic conditions. Further, a prior KFF review of the literature has shown that Medicare pays less for physician services, on average, than private insurers, leading physician groups and some policymakers to warn about potential access issues for beneficiaries that could result if physicians are driven to opt out of the Medicare program in the future due to payment rates.

However, access problems for beneficiaries have generally not materialized to date. According to MedPAC, Medicare beneficiaries report access to clinician services that is equal to, or better than, that of privately insured individuals. A recent KFF analysis found that just 1% of all non-pediatric physicians had opted out of the Medicare program in 2023, suggesting that the current fee structure has not substantially discouraged participation. Moreover, MedPAC estimates that virtually all Medicare claims (99.7% in 2021) are accepted on “assignment” and paid at the standard rate, with beneficiaries in traditional Medicare facing no more than the standard 20% coinsurance rate.

Primary Care Compensation: A second concern with the current payment system is that Medicare does not adequately pay for primary care services, as reflected by the gap in Medicare payments between primary and specialty care clinicians. Payments under the physician fee schedule are generally higher for procedures (e.g., surgeries) than non-procedural services (e.g., evaluation and management). MedPAC has expressed concern that this imbalance encourages clinicians to focus on more costly and profitable services at the expense of high-value, but less profitable, services, such as patient education, preventive care, and coordination across care teams, which leads to higher physician spending over time.

Role of the QPP: QPP programs such as MIPS and bonus payments for A-APM clinicians are designed to create incentives for quality improvements, care coordination, and high-value services. While the share of clinicians who qualify for A-APM bonuses has increased substantially since the QPP began (from roughly 99,000 in 2017 to 271,000 in 2021), some policymakers have argued that greater incentives are needed to encourage providers to take on the financial risks and high startup costs associated with these models. Additionally, MedPAC has expressed concern that MIPS, the quality-based payment program for clinicians who do not participate in A-APMs, does not give providers enough incentives to improve quality and control costs. As noted earlier, a large share of clinicians are exempt from the program, and because few participants receive negative adjustments, positive adjustments are relatively modest.

In addition to legislation that directly addresses the 2024 payment cuts, policymakers and others have put forward a number of strategies to revise the current physician payment system. These include measures to prevent fluctuations in payment from year to year, provide additional support to primary care and safety-net providers, and create stronger incentives for efficient spending, care coordination, and participation in A-APMs.

Several bills have been introduced in Congress that would raise or modify the budget neutrality threshold, allowing CMS greater flexibility to adjust payment rates to reflect evolving policy priorities without necessitating a mandatory payment cut. For example, legislation has been introduced that would provide regular updates to the budget neutrality threshold based on growth in the Medicare Economic Index (MEI), a measure of inflation in the prices of goods and services used by clinicians to provide care. Further, a bipartisan coalition of physicians in Congress recently introduced the Strengthening Medicare for Patients and Providers Act, which would tie annual updates to the fee schedule’s conversion factor to the annual percentage increase in the MEI.

In 2023, MedPAC also recommended a one-time inflation-based increase to physician payment rates in 2024 (equal to 50% of the projected increase in the MEI), but has not recommended annual updates for inflation, focusing instead on targeted strategies to bolster payments to primary care clinicians and safety-net providers. Their recommendations include a permanent add-on payment for services provided to low-income Medicare beneficiaries, raising payment in these instances by 15% for claims billed by primary care clinicians and 5% for claims billed by non-primary care clinicians.

MedPAC has voiced support for the goals behind MACRA and the QPP, including the financial incentives offered to A-APM participants under current law. At the same time, MedPAC has recommended significant changes to the design of the QPP, including the elimination of MIPS, based on concerns that it does not give providers enough incentives to make significant practice improvements. In its place, MedPAC has recommended a voluntary program designed to mimic the structure of A-APMs and other alternative payment models, allowing clinicians to transition into these models more gradually. Finally, some policymakers have introduced legislation that would extend bonus payments for qualifying A-APM clinicians though the end of 2026.

In addition to these more targeted proposals, a bipartisan group of senators recently announced the formation of a Medicare payment reform working group, which will investigate long-term reforms to the physician fee schedule and updates to the physician payment legislation provided by MACRA.

Not yet 10 years out from the passage of MACRA, these measures suggest growing interest in Medicare physician payment reform, beyond addressing the physician fee cuts finalized for 2024. Designing payment approaches that address concerns raised by interested parties to compensate physicians adequately while restraining spending growth represents a challenge for policymakers.

This work was supported in part by Arnold Ventures. KFF maintains full editorial control over all of its policy analysis, polling, and journalism activities.